Car plants caught by new warehouse tax

Ten things the Budget did and didn’t do for EVs

Hello, I’m Tom Riley, and welcome back to The Fast Charge, a British EV newsletter.

Top story today... Everything you need to know about yesterday’s Budget and how it will help or hinder the UK’s EV transition. Including how the Chancellor’s new business rates regime to tackle distribution centres may inadvertently cost car and battery plants millions.

As ever, if you have any comments or feedback, please reply to this email or message me on LinkedIn.

Ten things the Budget did and didn’t do for the EV industry 💷

Summary: Last night, when I eventually slumped into my sofa, I felt the immortal words of Harvey Price wash over me: “Ohhh, what a day!” And I’m sure I’m not alone across the EV industry in feeling a bit torn about the Budget yesterday. Yes, there was a lot of good about it for EV drivers and the industry supporting them; however, I feel the bad bits are, well, bad enough that I wouldn’t be surprised if we didn’t see carmakers yet again fighting for more mandate leeway as a result.

Here’s a breakdown of ten relevant EV announcements and outtakes from the Budget, including key industry reactions.

1. Introduction of the electric vehicle excise duty 👎

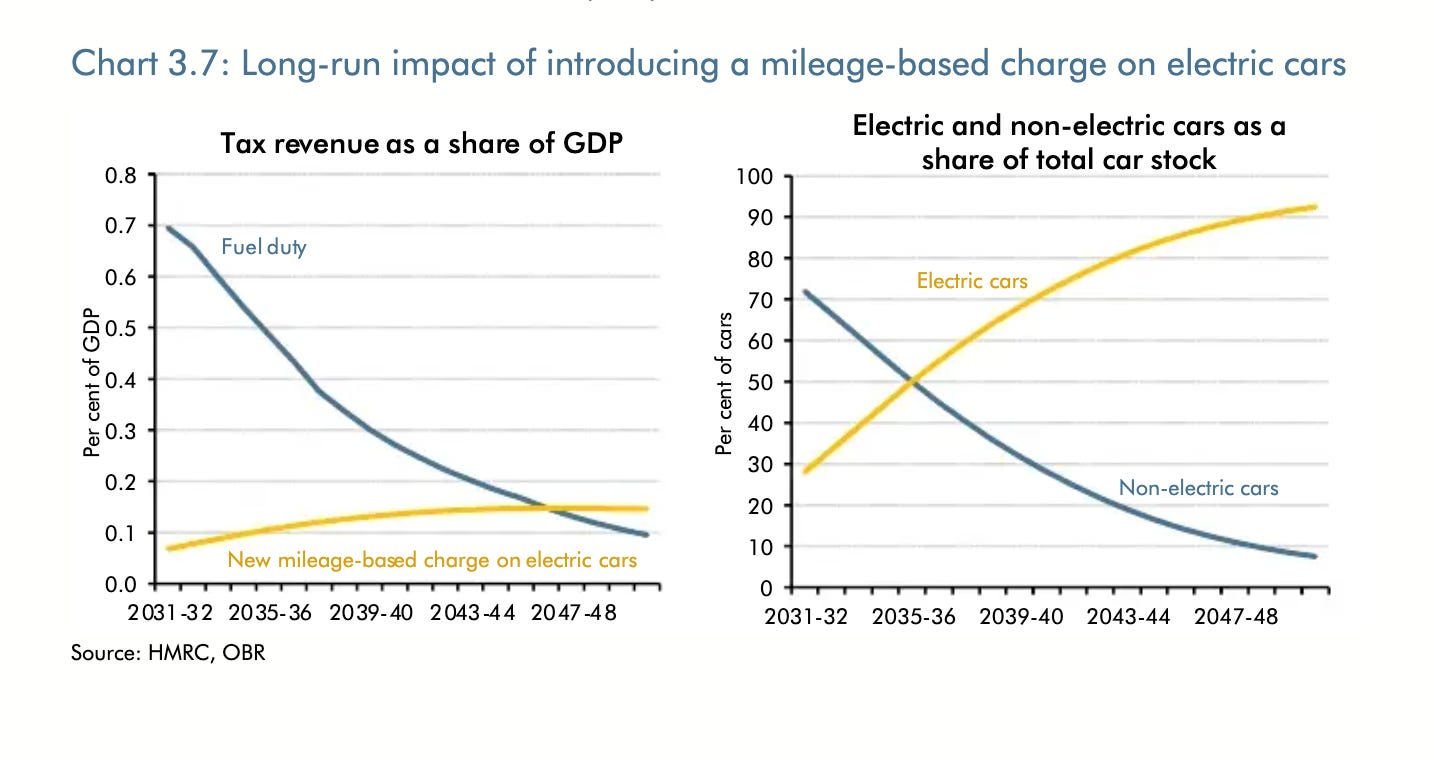

As was widely briefed before the Budget, yesterday the Chancellor announced the introduction of a new ‘eVED’ scheme that will start from April 2028. A consultation on the design of the scheme has been published. In short, you will pay up in advance, your annual MOT will be used to check what you did or didn’t drive, and then there’ll be a balancing payment or credit. The scheme will apply to EV’s at 3 pence per mile and Plug-In Hybrids at 1.5 pence per mile. The reason the latter is lower is that PHEVs also require fuel, which is already caught by fuel duty. However, with ranges for PHEVs getting longer, it is possible people could, if trying really hard, run their PHEV cheaper than an EV. According to the Office for Budget Responsibility, the scheme is estimated to reduce EV sales to 2030 by 440,000 cars. However, due to other measures announced by the Chancellor, it’s only estimated to be 120,000. Which is still a hit on sales at a time when the ZEV trajectory is throttling up. The OBR separately suggests in some neat graphs that, even at 3p per mile, it will not be enough to replace fuel duty. Expect 3 pence to be the starting point. Find the consultation here.

2. Fuel duty was kept frozen 🥶

It would have been political suicide for the Chancellor to go near fuel duty. Instead, the temporary 5p fuel duty cut remains in place until returning to normal in March 2027. Meanwhile, the 2026/27 inflationary rise to the whole duty, expected in 2026, has been cancelled.

3. Ten years of business rates relief for charging networks 👊

A real triumph for the EV charging industry yesterday, as they secured a whopping ten-year 100% relief on having to pay business rates on charge point bays or forecourts. This is good news for drivers as it will help keep prices at the plug down.

4. Car and battery plants could pay millions more under new rates 🚗

In not-so-good news, the Chancellor confirmed a change to the business rates system yesterday, which will see large ‘out of town’ non-domestic properties, such as Amazon-style distribution warehouses, paying a new ‘high-value multiplier’. This is so the Treasury can offer lower rates for high street retail, hospitality, and leisure businesses.

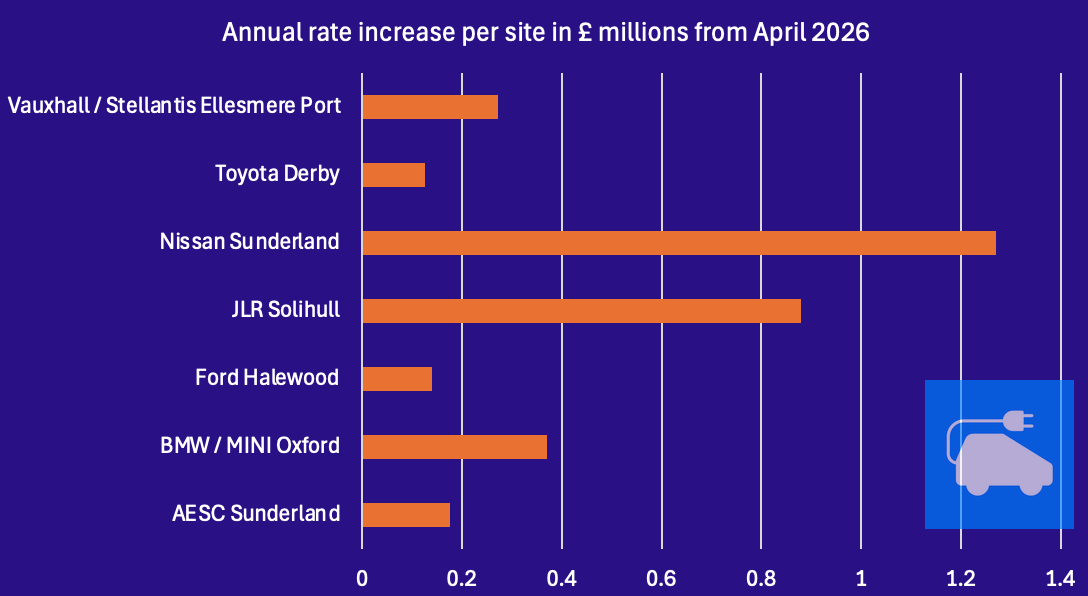

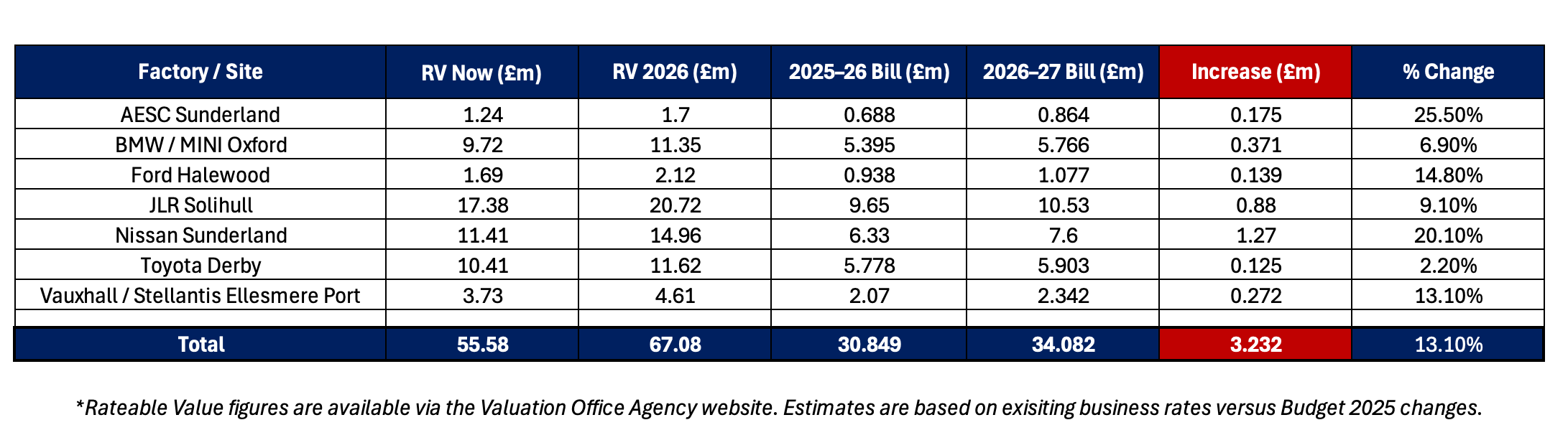

However... the knock-on impact of the Treasury’s move is that British car plants and battery manufacturing sites in the UK are, as I understand it, caught in the same ‘high value’ net. And, based on analysis of seven sites in the UK belonging to Ford, Stellantis, Nissan, JLR, BMW, and Toyota using Valuation Office Agency data, I’ve calculated these sites will have to pay an average 13% more from April 2026, equating to a £3.2million increase across all of them, further to the Budget yesterday.

Why? Explain it like I’m five. Business rates are charged on most non-domestic properties. The rate you pay is based on taking a property’s ‘rateable value’ – which is set by the VOA (an agency of HMRC) – and multiplying that value by a rate set by the Government. Before the Budget, there were two ‘multiplier’ rates – one for small businesses (with values below £51,000), which was 0.499 (49.9p), and a standard rate that applied to all properties valued above £51,000, which was 0.555 (55.5p).

In short... Pre-Budget, car plants and gigafactories would have paid the standard business-rates multiplier like most businesses. But, based on the Treasury’s plans, in 2026, they’ll be placed into a new high value band as most of their sites are rated above £500,000. And, although the Treasury has set the ‘high-value multiplier’ at a lower rate compared to the previous ‘standard’ – it’s going from 0.555 to 0.508 (50.8p) – because the VOA is updating all these sites’ values from April 2026, they will still end up paying millions more per year. The table below gives an indication.

And that’s not all. As while the high-value multiplier has been set initially quite low, in the Budget documents, the Treasury indicated the government could put it up further:

“The government has the legislative flexibility to set the higher rate up to 10p higher than the national standard multiplier. However, this higher rate is being set at only 2.8p above the national standard multiplier in recognition of the important role these properties play in the government’s growth mission. The high-value multiplier will be 50.8p in 2026-27.” [Search for Box 3.H.]

👉 The Treasury is consulting on the impact of the new business rates scheme and wants to hear from industry. Find it here.

5. Expensive Car Supplement raised to £50,000 🙏

In lighter news for carmakers and dealers, the Expensive Car Supplement threshold was raised from £40,000 to £50,000. According to Autotrader, this means 57 more EV models will not have to pay an additional £425 annually from the second year of purchase to year five.

6. New funding for the EV grant and infrastructure 🤑

Talking of good news, as briefed, the Chancellor confirmed that the Electric Car Grant and the EV charging sector are getting a £1.5 billion boost. Most of that will go into the grant scheme, with £200m earmarked for charging. This is key in offsetting those lost sales caused by the new mileage tax on EVs. Additionally, yesterday finally saw the Department for Transport publish a consultation on making changes to permitted development rights. Though move quickly, it closes in January. See here.