Revealed: What carmakers really thought about the ZEV mandate

Special report: Carmaker responses to ZEV mandate design consultation

Happy New Year! I’m Tom Riley and welcome to this special edition of The Fast Charge, a British EV newsletter.

Why is it special? Well, I am publishing the written submissions by major carmakers to the UK government about its design of the zero emission vehicle (ZEV) mandate.

Specifically, these documents reveal the private lobbying by carmakers about the proposed targets – which came into force yesterday – and how the mandate’s certification scheme should be designed.

I obtained these documents via a Freedom of Information request in 2023 and they have been reported on exclusively in The Guardian newspaper - huge thanks to Jasper for a great write-up.

Further below is a longer look at some of the revelations and links to each carmaker’s response, but here are the headlines…

Major carmakers argued that the ZEV trajectories were unachievable without flexibilities being added

Several large carmakers called for the 2024 start date to be pushed back in some form (e.g. Toyota, Nissan, JLR, Stellantis) with others suggesting it should be more robust (Tesla, Ford, VW)

Some carmakers advocated that hybrid vehicles should count towards the ZEV mandate (e.g. Toyota, MG); and

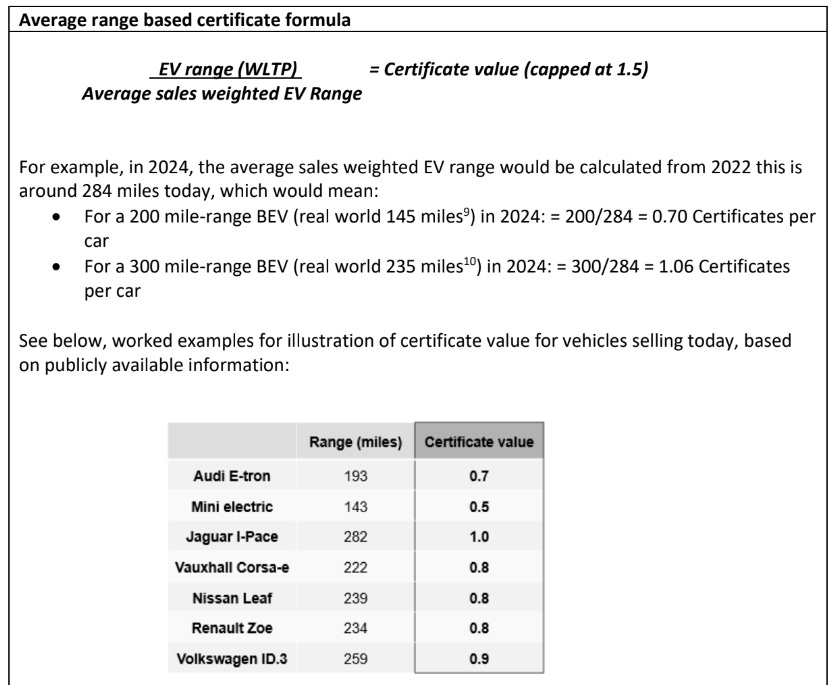

Tesla was seemingly the only carmaker that believed ZEV certificates should favour cars with longer ranges – while nearly everyone else advocated a simpler 1 ZEV car to 1 ZEV certificate system.

Carmaker’s views on the ZEV mandate targets

Background (i): After the government first unveiled its plan to ban new petrol and diesel vehicles in 2020, it proposed rules in 2021 that would mandate carmakers to sell an increasing number of ZEVs up to 2035 – when all types of internal combustion cars would be illegal. It’s a mega climate policy, and as such required the government to hold several consultations with industry.

Background (ii): One of the most important was the ‘technical consultation on ZEV mandate policy design’, as this was when the government sought views on yearly targets for carmaker sales (the trajectory). The consultation ran from April to June 2022, and the outcome was published in Spring 2023. And, despite the government’s ‘pushback’ last Summer, the targets in this consultation became law and kicked off yesterday (January 3rd).

Views revealed: More than 20 carmakers responded to this consultation, providing their thoughts and positions on numerous questions the government asked. I made my first Freedom of Information request to see their responses in Spring 2023, though I was refused on account of the policy still being worked on. However, after resubmitting a request post-Sunak’s 2030 pushback speech, I finally got a response in December. Further down this email, I have copied details of my FOI and links to all the documents.

The FOI contained documents from… Ariel Motors, Aston Martin, Bentley, BMW Group, Caterham, Ford, Honda, Jaguar Land Rover, LEVC, Mazda, McLaren, McMurtry Automotive, MG Motors, Nissan, Renault, Renault Trucks, Ssangyong, Stellantis, Suzuki, Tesla, Toyota, and VW Group.

Summary: Based on my analysis, it seems that the majority of carmakers argued that the ZEV trajectories were too ambitious or that they would not be able to comply without banking or borrowing options for certificates. Several prominent carmakers with operations in the UK suggested reworking the 2024 start date by some years (including Stellantis, Toyota, and Nissan). The result of the consultation was the addition of flexibilities for carmakers.

Now, before you get stuck in… let me just caveat everything with three points. Firstly, as well as the carmakers who argued to weaken the mandate, many were positive. Secondly, this consultation happened at a different time, when the pandemic was in the rear mirror, and the EV industry itself was still in start-up mode. Thirdly, you will see redactions in the docs where the carmaker’s comments were not relevant to my request or were commercially sensitive.

Anyway… links below, and I’ve also highlighted my top takeaways from Toyota’s, Tesla’s, Jaguar Land Rover's, Stellantis's, and Nissan’s submissions.

Toyota…

They lobbied for hybrids to get ZEV certificates and claimed the mandate would damage their brand. In their response, Toyota were…

“Extremely concerned” by the 22% target from 2024, saying it would not be able to comply – called for a delay to 2025.

Suggested the ZEV mandate would penalise it “both financially and in terms of its brand reputation”.

Lobbied for hybrid vehicles to be included under the mandate, suggesting that they receive “partial” certificates.

Claimed the carmaker may have to “pay penalties” or even “reduce the number of vehicles it manufactures”.

Suggested without flexibility there would be a risk of “damaging production, investment, competitiveness and profitability”.

Argued against having certain vehicle characteristics favoured, such as range, suggesting there “is no ‘one-size fits all’ solution”.

Tesla…

They said the UK is going slow and advised the government to ensure EVs displace ICE miles by favouring cars with longer ranges. In their response, Tesla said…

The trajectory and targets were too weak and should be increased in earlier years – starting from at least 30% in 2024.

Proposed for the mandate to be brought forward to 2023 for non-binding early action.

Lobbied for a certificate scheme that was based predominantly on range, suggesting cars like the Mini Electric should be valued less as they displace fewer ICE vehicles miles – they created their own formulas (screenshot below).

Advised the government on having biannual reviews so the trajectory could be adjusted if necessary.

Stellantis… (owner of Citroen, Fiat, Peugeot, Vauxhall and more)

Called for a delay to 2025 and argued against prioritising range for mandate certificates. In their response, Stellantis…

Considered the trajectories “very ambitious” and called for a delayed start to 2025.

Lobbied for annual targets to be accompanied by banking or borrowing options.

Supported the idea of a simple 1:1 credits for each ZEV.

Argued against complex vehicle certificate criteria, suggesting range as an example of a cost driver that would “disincentivise” smaller vehicles.

Read Stellantis’ response here.

Jaguar Land Rover…

They suggested the government should acknowledge the proposed trajectories are “unachievable for most manufacturers”. In their response, JLR were…

Dismissive of the target trajectory, claiming in early years it is set at “unachievable levels”.

Said the government had given “very little notice” to manufacturers with “no scope” for them to react.

Wrote that JLR “cannot support annual targets in isolation”.

However, argued that with the “inclusion of flexibilities”, such as borrowing ZEV certificates between 2024-27, then the trajectory would be manageable.

Supported 1:1 credit system in early years, proposing a separate consultation on a car incentivisation scheme.

Nissan…

Despite being an early EV leader, the carmaker wrote that the 2024 and 2025 targets would be a “particular challenge”. In their response, Nissan…

Proposed that the mandate should come in from 2024, but “not being enforced until 2026.”

Called for multi-year flexibilities and certificate trading.

Said, with the potential timelines to 2024, they would be unlikely to meet 22% of sales in 2024 without flexibilities.

Advocated for a 1:1 ZEV certificate scheme, like many other large carmakers.

Suggested that any changes to the certificate allocation system in future years would undermine carmaker investments over the long term.

👉 Here are links to all the documents I received.

If you plan to use, quote, or share these responses, please ensure to credit The Fast Charge.

Background info about the FOI request

My FOI related to responses from carmakers to the government’s technical consultation on the ZEV mandate policy design, which first introduced the proposed mandate targets.

The technical consultation ran from 7 April to 10 June 2022. Link here to the original document. The Government’s response was published here in Spring 2023.

The trajectories proposed in this consultation are now law, though as a result of the lobbying, concessions were made in the design, such as allowing carmakers to miss targets in one year if they sold more in other years.

I requested responses to the following questions in the consultation:

Q1a. What is your view on the potential trajectories the ZEV mandate for cars should follow and why? Q1b. What is your view on annual targets for cars?

Q3a. What is your view on how the certificate system should operate and on our initial long list of potential vehicle attributes that could be rewarded / incentivised? Q3b. Please provide detail on options you specifically support or oppose. Q3c. Are there additional options not listed we should consider? Q3d. What are your views on how flexible the ZEV certificate system should be over time?

If you have any questions, please leave a comment or reply to this email ⚡️

By Tom Riley | Check my Linktree for LinkedIn, TikTok and Twitter

Excellent work

Very insightful, thank you for your work (came here after seeing your research referenced on The Telegraph, via CarbonBrief)