Government denies favouritisim over Connected Kerb investment

As EV network executives question if Aviva had a hand in the decision

Hello, I’m Tom Riley, and welcome to The Fast Charge, a British EV newsletter.

Top story today… Last week, the government announced millions of pounds for Connected Kerb. It’s gone down quite badly amongst some network executives. I take a look at everything and speak to the National Wealth Fund…

Elsewhere… Lots of new industry figures, the majority think ‘normal’ people drive EVs, and the government is in talks about possible car financing.

If you have any comments or feedback, please do get in touch by replying to this email or using the links below.

Industry questions Connected Kerb government investment

Background: Last week, Chancellor Rachel Reeves delivered a major speech on growth to try and battle down some of the negative economic rhetoric that had started to overtake the media agenda. In this speech, Reeves revealed two of the first investments being made by Labour’s new ‘National Wealth Fund’ (formerly the UK Infrastructure Bank). One of the lucky businesses in question was the charging network Connected Kerb, which received a whopping £55 million from the government (aka, you and I) and an additional £10m from Aviva, the global asset manager.

Summary: This news has not gone down well in the EV charging industry, some executives are said to be quite suspicious of how it came to happen. It’s no secret that, in recent years, Connected Kerb has struggled to hit many of its previous lofty targets - in 2022 it promised 190,000 public chargers by 2030, today it hopes for 40,000 by 2027.

Why the slip? Presumably, Connected Kerb has struggled to gain the ground it imagined a few years ago for several reasons. Clearly, the political upheaval and negative rhetoric has not helped the business case. Likewise, many tenders won by the company may have stalled while local authorities waited to see what would happen, or and also waited to get their Local EV Infrastructure funding. This is why since 2023, Connected Kerb ultimately had to resize - at least 30 people left over the past 18 months, according to LinkedIn.

However… What has annoyed other networks is that, while it’s been tough for Connected Kerb, it’s been tough for everyone. Likewise, many have often cautioned about Connected Kerb’s plans itself. For example, one of its original products to allow on-street charging was a charger almost hidden in the ground. I’m told this is quite fiddly for UK streets, and it seems to have since evolved to a more standard device more akin to a post.

Likewise… One of the early wins for Connected Kerb was for Coventry’s authority in 2021, where the local council wanted 400 charge points. This has since been noted by DfT, as recently as two weeks ago at the Public Accounts Committee, as a best practice approach. However, I have also heard several different CPO executives question this before and wondered if they went in too big too quickly.

Finally… Let’s talk about what has actually gone in the ground for the public to date. According to the NWF press release, Connected Kerb presently has about 9,000 chargers already built. But, where are they? On Connected Kerb’s own live map, only 1,093 locations are on show - with 355 of those in Coventry. Even on Zapmap, the network is only listed as having 5,865 at the last count. It is likely they are counting connectors.

Look… This is not an attack on Connected Kerb, I am purely sharing some context as to why so many other networks - who probably would have also liked this sort of financial support - were so quick to question why the hell they got it, and not them.

They may be forgiven for being suspicious… Back in July 2024, the new Chancellor brought together a special taskforce to advise on the setting up of the National Wealth Fund. As well as including big names in finance like the former Bank of England Governor Mark Carney, one of those who joined the task force was Dame Amanda Blanc… CEO of Aviva.

Yes, correct… That is the same Aviva that in 2022 made an eye-watering £110m investment into Connected Kerb. The splash at the time, especially for Aviva, was big. It’s perhaps also why many executives this past week have been quick to label the NWF’s investment a ‘bailout’ and a ‘subsidy’.

To check, I asked the National Wealth Fund how the investment came about. They have been adamant that it was Connected Kerb that approached them first, not the other way round. I’m told the project Connected Kerb put forward was assessed against their mandate, Investment Principles and was approved by the NWF Investment Committee. They also made clear that other networks can get in touch, and that they have been speaking to other CPOs. Best link is here.

Just to bottom it all out... I explicitly asked the Treasury to confirm if Connected Kerb was the first CPO they spoke to. They confirmed it was not. Aka, they’d been speaking to other CPOs before Connected Kerb’s approach to them. This tallies with what another CPO executive told me on this, suggesting that some networks may just be upset at Connected Kerb as they had not thought to get in touch.

Finally, on the comments made about Aviva’s link in the NWF’s creation… I don’t believe these are fair and I have been strongly assured by Aviva that their CEO was only involved in advising on the NWF’s set-up, and was not involved in any investment discussions nor shared information that would have supported Connected Kerb’s case.

However… that still leaves a question which is: what did Connected Kerb have that other didn’t? The NWF’s investment principles (below) are extremely broad in scope. Certainly, it is not obvious exactly what advantage they could have had over other CPOs that have been in contact.

Thankfully… we have our good friend Señor FOI who I’m sure will snuffle out the application soon enough.

At the time of the investment… CEO of Connected Kerb Chris Pateman-Jones, said: "This investment combines Connected Kerb’s proven hardware and advanced software infrastructure with the financial resources of NWF and Aviva to deploy public charging at scale, to all corners of the UK. This is a game-changing investment that will give individuals and businesses the confidence to make the switch to driving electric, dramatically reducing carbon emissions and air pollution. We are delighted to have such high-profile investors who are deeply aligned with our sustainability and ethical goals.”

In other news…

🆕 This morning, after many months of delay, the Department for Transport published several data dumps highlighting the latest quarterly figures for public chargers. See here. My analysis will arrive next week.

🚘 Elsewhere… clear evidence this morning that the EV transition in the UK is alive and well, with both the Society of Motor Manufacturers and Traders, plus the think tank New AutoMotive, revealing that 21.5% of new cars were electric, up from 15% January 2024. Vicky Edmonds, CEO of EVA England, reacted to the figures saying: “Great to see new EV sales record their best ever start to the year.” Mike Hawes, SMMT Chief Executive, was more cautious saying: “January’s figures show EV demand is growing – but not fast enough to deliver on current ambitions. Affordability remains a major barrier to uptake, hence the need for compelling measures to boost demand, and not just from manufacturers.” Read more.

📰 Speaking of the ZEV mandate, Autocar Magazine has published its response today. It certainly is an interesting read. To the headline question about whether the government should only consider hybrids, the mag takes a different view saying, “there are technologies other than HEV and PHEV that are also low or zero-emission capable at the tailpipe – such as hydrogen fuel cell, hydrogen combustion and synthetic e-fuels.” Autocar acknowledges that “there are questions about the viability of such technologies”, but it would, “support a solution that encourages innovation in different energy sources that might prove viable long-term.” I’m sure this view will provoke some debate! Read their full response here.

🚙 There was a lot of feedback to my piece last week about NIO potentially investing into the UK through a partnership with Forseven. Well, one person has since flagged to me a further - and clear link - between the two companies. And that is Nick Collins, CEO of Forseven, but who is also listed as a Director on NIO’s website. Cowabunga.

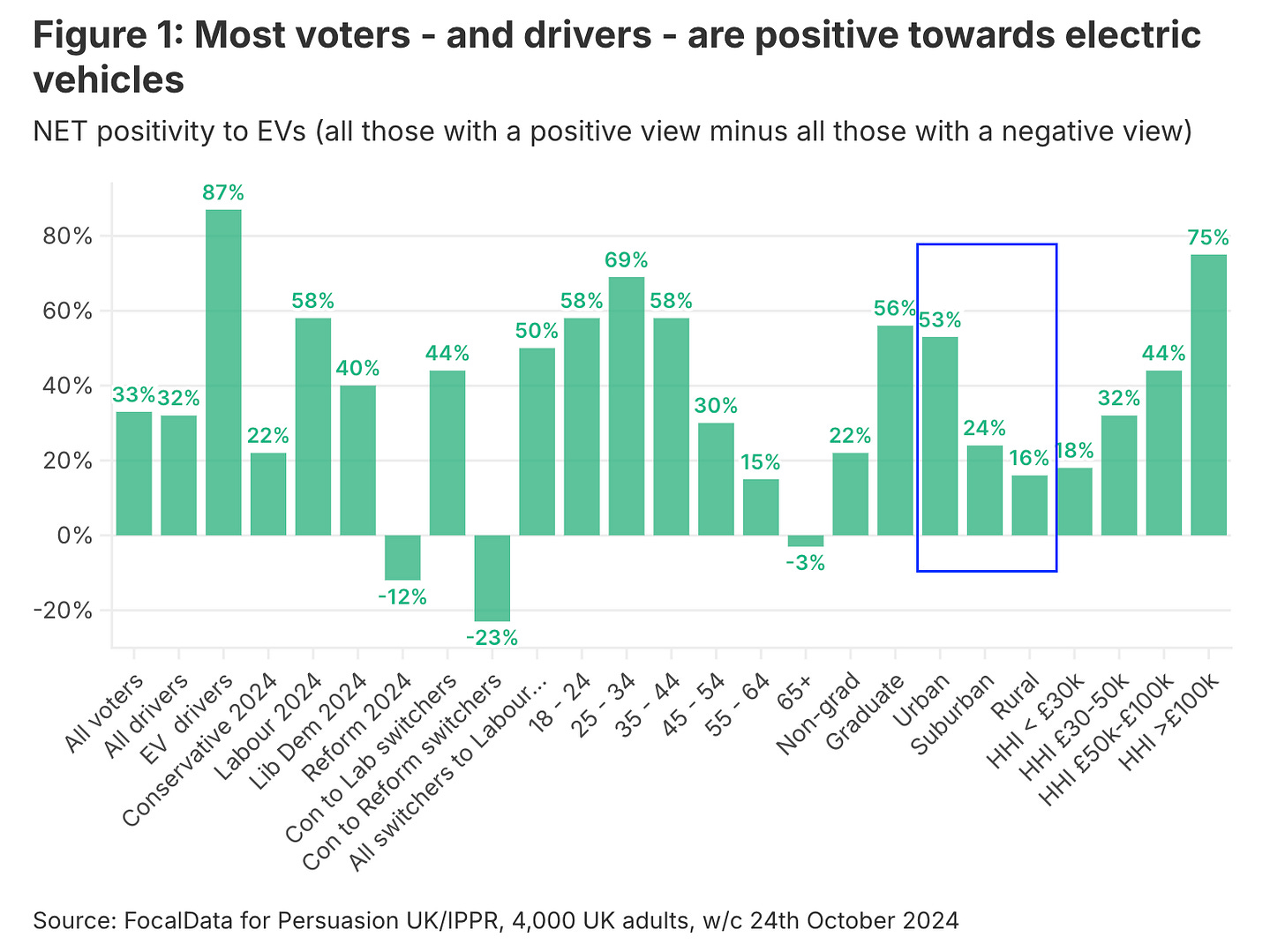

🏡 The left-leaning think tank IPPR published some super interesting research this past week. The top takeaway was that most voters - and drivers generally - are positive towards EVs, and think ‘normal people’ drive them, not just this ‘elite’ everyone talks about. However, in this research, one item that caught my eye was that while 53% of urban people were net positive to EVs, only 16% of rural folk were. Maybe urban people come across them more or care more about clean air. But, given we’re forever hearing about cost, and presumably more rural people have off-street options than urbanites (aka, could be cheaper), it vexes me. I’m terribly vexed. Find the research here.

🏎️ Ferrari has said it will unveil its first electric supercar in October. The CEO Benedetto Vigna said today in an earnings call that its car would be “unique and innovative”. Read more (paywall).

💡 According to the FT, the government has started talks with the car finance sector on how to make more low-interest or interest-free loans available to help more drivers buy EVs. My view on this is… if it does come to fruition, the money should be aimed at used EVs, not new cars. New EV tech is changing all the time to this day, leading to a cycle of depreciation - so this policy would be like firing pound notes into the abyss. Instead, any money should be targeted at used EVs. This would go further, and prevent many leasing firms from having to crystalise their huge losses on depreciated new EVs now returning to them used. Rant over.

💷 The Telegraph* has written up a piece about DfT’s recent visit to Parliament and the Rapid Charging Fund delays. Or, read my write-up from two weeks ago.

*Note. As the Telegraph chose not to reference me in their write about BT’s charging plans recently, this is just a link to Monty Python’s Money Song.

🚲 In more serious and sad news, the innovative e-cargo business, Zedify, is seemingly in a difficult place and currently trying to ‘salvage’ its operations. See a LinkedIn post here.

⏰ According to the AA, off-peak EV charging across fast, rapid, and ultra-rapid public charging fell by up to 28% in December. Read more.

🤑 On this topic… InstaVolt and lower prices… in the same sentence? You must be ‘avin a laugh! Alas, no, the rapid network revealed yesterday that it is extending the time drivers can benefit from it’s off-peak tariff by a further 2 hours. What this means is the cost between the hours of 9pm-7am will now be 54p per kW for UK app users. Read more.

😲 Not so good news for InstaVolt, they seemed to be pictured a great deal in a BBC article this week about Bradford’s rollout of EV chargers. Read more.

💸 New research has revealed that average EV repair costs have fallen to £3,482 by the end of 2024. The new data also found that repairs for Chinese brands MG and BYD were around £2,300, which is more than 30% lower than the EV average. Read more.

🚓 The day before Osprey's new 16-charger rapid hub was due to open in Paisley, its cables were snatched. Although the cables are worth only £10 each in scrap, replacing them can cost hundreds, if not thousands. This issue keeps popping up. In this case, Osprey is rolling out physical anti-theft measures, such as alarms that sound when cables are cut, cable protection sheaths, and tracking on the cables. Read more.

⛰️ The charging network Be.EV is installing three ultra-rapid charging hubs in Northumberland in a bid to support people do ‘eco-tourism’. To paraphrase the immortal words of King Charles… “whatever ‘eco-tourism’ means”.

👨💻 Finally, a personal update. In December I revealed plans to launch my own insight and advisory offer in Spring that would build on this newsletter, plus my 11+ years in Westminster and the private sector. This plan remains and I’ll be sharing more info in the coming weeks. I’m also very thankful for all the interest from many of you. Exciting times are afoot!

Wrt Bradford, commercial operators will fill the high demand areas, but quieter areas lack coverage. Single chargers may be a better match for demand, but are not something users can rely on as they may be busy.

Chargers aren't like petrol pumps where they can rely on a high throughput with tiny margins. The much longer cycle time means you need more over capacity and the associated higher margin. I'm sure this will change with time, but we have at least a decade before most cars are electric.